TRICARE, the health insurance program for military personnel, retirees and their families, recognized by 2015 that it had become the target of corrupt pharmacists, doctors and marketers peddling wildly overpriced compound drugs, mostly ointments and creams touted to ease joint pain or fade scars.

By the time TRICARE officials imposed a new method to flag and deny coverage of compound drug prescriptions favored by scammers, the military pharmacy program had been bilked out of an estimated $1.5 billion.

In June that year, officials from the Defense Health Agency, which oversees TRICARE, met with senior officials at the Department of Justice to share their experiences with compound medication scams and to seek help.

DHA representatives that day included Bryan Wheeler, a retired Air Force lawyer, former military judge and current DHA deputy general counsel, and Navy Capt. Edward Norton, with the agency’s pharmacy operations division.

“We told them we had gotten a fix on the ongoing problem but we had all this money already spent that we needed assistance in recovering. And we got their enthusiastic assistance,” Wheeler said in a phone interview Tuesday. “We have been working those cases pretty strongly now for the last three and a half years.”

Results so far include 60 arrests or indictments, at least 50 fraud convictions, and recovery of more than $280 million restored to the TRICARE program.

“We can use that on health care -- either TRICARE beneficiary care at military treatment facilities or for legitimate prescriptions, or to provide care to children with autism or whatever the benefits are we have out there. That’s money that is repurposed consistent with [the TRICARE] statute,” said Wheeler.

More than 100 pharmacies nationwide likely were involved in the compound drug fraud against TRICARE. There is a five-year statute of limitations on prosecuting crimes of fraud against the federal government. Therefore, the Defense Criminal Investigative Service, law enforcement partner agencies and U.S. attorney offices across the country are battling the calendar.

On progress to date with criminal prosecutions, Wheeler said “we are probably close to half way there.” However, there is no statute of limitations on recovery actions for money stolen from TRICARE or other federal programs.

Pharmacists create compound drugs by combining more than one medicine to produce a product not available from commercial drug manufacturers. There are legitimate uses for compound medications, Wheeler said.

For example, if a child is unable to swallow pills, a local druggist might grind pills and mix them with a suspension liquid that the child can drink. Or for a patient who has lost thyroid function, to avoid a yoyo-like regimen of shots and pills, a physician might titrate the level of hormone treatment delivered by prescribing a compound medicine as a cream that can be applied topically, Wheeler said.

What bad actors in the pharmacy industry did over the last decade or so was produce compound drugs of unproven effectiveness; conspire with unscrupulous health care providers to write prescriptions for them, and create marketing networks to target health insurance plans with relaxed rules on compound drugs.

While the rest of the health care industry gradually got wise to compound drug scams, TRICARE became the juiciest remaining target with its generous pharmacy benefit, lax rules on compound drugs, and mail order pharmacy software that would cover the cost of multiple medicines in a single prescription.

Captain Norton, the DHA pharmacy expert who joined our phone interview, said the schemes typically involved ointments or creams because, though not shown to be medically effective, they typically don’t endanger patients.

“It was almost like the perfect fraud,” Norton said, “because they could make a lot of money [without] risk of an adverse medical effect.”

Like thousands of other military retirees, Wheeler became a target in May 2015, the same month TRICARE adopted new policies to block compound drug fraud. He got a robocall at his office in DHA headquarters in Virginia, advising that his health insurance would cover the cost of a special medicine for joint pain.

Wheeler and a colleague returned the phone call and took careful notes to share with the TRICARE program integrity office and law enforcement.

“Turns out the call came from a call center. The individual didn’t want to tell me where it was located but [t]his was a fairly sophisticated crime. Somebody had fronted money to set up the center, hire individuals to make calls [and urge] people to request a prescription” for a pain cream. Wheeler was told he could “verbally authorize” the pharmacy during that call “to fill a prescription on my behalf.”

“Do you want me to go see my doctor about this?” Wheeler asked.

“He said, ‘Oh no. We don’t want to interfere with the patient relationship. But we have a doctor who will give you a call and we will take care of this.’ ”

Beneficiaries enticed to try the medicine began seeing exorbitant charges to TRICARE, often tens of thousands of dollars. Drug refills, which beneficiaries often hadn’t requested, arrived at a pace far exceeding need. Wheeler said one doctor participating in the fraud wrote just over 100 prescriptions that cost TRICARE more than $1 million.

Recent guilty pleas spotlight how enormously profitable the scams were. Last month, Thomas Edward Spell Jr, a pharmacist who owned compound drug pharmacies in Mississippi and three others states, pleaded guilty to fraudulent claims that totaled more than $243 million.

Mike Hurst, U.S. Attorney for the Southern District of Mississippi, said Spell and co-conspirators formulated compound drugs, and marketed them to TRICARE beneficiaries, not to meet patient needs but to maximize profits.

“Ripping off our veterans and members of the military is despicable, and that is exactly what this defendant and others have done by defrauding TRICARE and the American taxpayer,” said Hurst Aug. 8, as Spell entered his guilty plea.

To encourage TRICARE users to try their pain drugs, Spell and co-conspirators would waive copayments. Pharmacy employees bought prepaid debit cards and money orders to cover the copays and then were reimbursed. Kickbacks and bribes were paid to doctors who wrote prescriptions.

Spell personally gained $29 million, filling bank and investment accounts not only in his name but for family members and various businesses. From these accounts he made loans and bought vehicles, boats and real estate.

Spell’s scheme relied on cooperation “throughout the highest professional levels in the medical and pharmaceutical industries,” said Thomas J. Holloman, III, Acting Special Agent in Charge of IRS Criminal Investigations. “Without the participation of those individuals in executive and decision-making positions, these schemes would often not materialize or profit those involved,"

Spell will be sentenced Oct. 16 in Hattiesburg, Miss. Related prosecutions continue in California, Tennessee, Arkansas and Connecticut. To date, fraud from his operation alone has resulted in 12 people charged and nine convictions.

Assets recovered by federal law enforcement are found not only in bank accounts, investments and real estate but in boats, mobile homes and exotic cars. The Department of Justice has specific guidelines for converting seized assets into cash before returning proceed to the government agency victimized.

Wheeler and Norton said many TRICARE dollars lost to the compound drug scandal likely won’t be recovered. And, while TRICARE is more effective today in blocking such scams, Wheeler said fraudulent activity continues.

“It’s like the metaphor of the old hotel burglar,” he said. “There are still people going down the hall, rattling doors.”

To comment, write Military Update, P.O. Box 231111, Centreville, VA, 20120 or email milupdate@aol.com or twitter: @Military_Update.

|

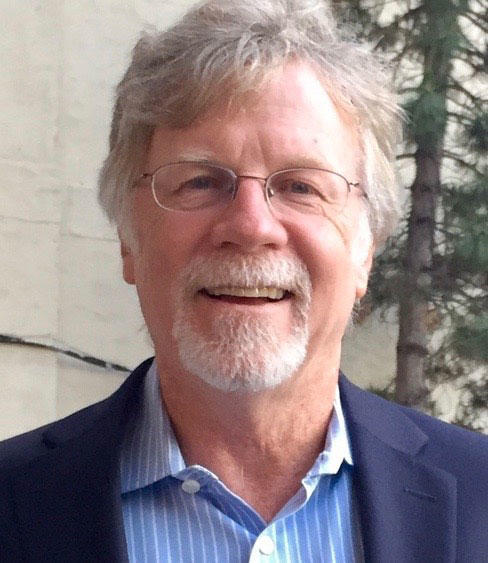

Tom Philpott has been breaking news for and about military people since 1977. After service in the Coast Guard, and 17 years as a reporter and senior editor with Army Times Publishing Company, Tom launched "Military Update," his syndicated weekly news column, in 1994. "Military Update" features timely news and analysis on issues affecting active duty members, reservists, retirees and their families. Tom's freelance articles have appeared in numerous magazines including The New Yorker, Reader's Digest and Washingtonian. |

|

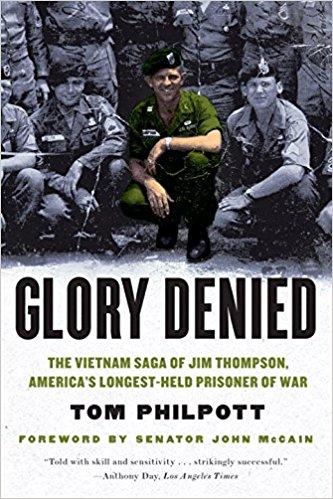

His critically-acclaimed book, Glory Denied, on the extraordinary ordeal and heroism of Col. Floyd "Jim" Thompson, the longest-held prisoner of war in American history, is available in hardcover and paperback on Amazon. |