Whether you're Active Duty, Reserve or National Guard, managing your day-to-day finances can have its unique challenges. However, with smart investing, a financially secure future is attainable.

Given the high degree of uncertainty that comes with being in the military, the steps to achieve life's big financial goals differ from the average person's. Training, permanent change-of-station moves (PCS), mobilizations and deployments can complicate family planning, saving for higher education, homeownership and retirement. Investing wisely at every stage of your career to retirement can help you stay on target to reach your goals.

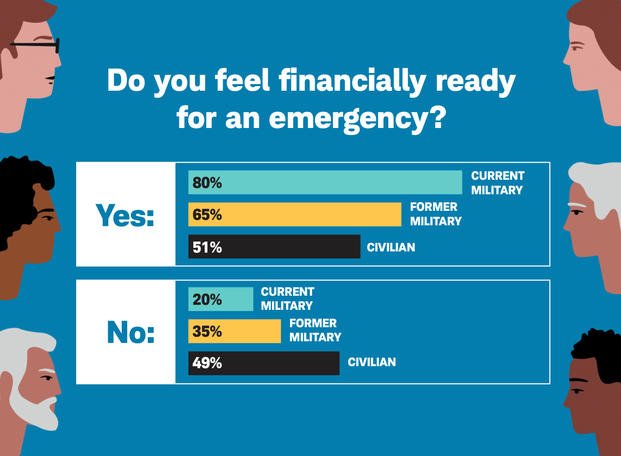

Before you even consider investing, you need to have an emergency fund set aside. A 2020 financial literacy survey by Charles Schwab found that 46% of service members said an unexpected expense of as little as $500 would cause financial hardship if they had to pay it in full within 30 days. As a rule of thumb, aim to save three to six months of essential living expenses that you can quickly access in case of emergency, and save more if you're anticipating a major life change in the next year.

Once you've set aside an emergency fund and are ready to invest, it's vital to understand that investing is different from saving. If you don't save, you can't invest. Put differently, if you save $0 you will have $0 to invest. While saving implies setting aside and parking your money in a safe and accessible account without significant opportunity for growth, investing can involve more risk but provides the opportunity to build and grow wealth.

Get Invested as Soon as You Can

When it comes to investing, getting started is the most important step. The sooner you start, the better, thanks to something called compound growth. By investing small amounts of money consistently over time, you'll be on the right track to financial independence.

You can do this by taking advantage of workplace retirement benefits with the Thrift Savings Plan (TSP), which is a part of the Blended Retirement System (BRS) and includes a traditional pension if you retire from the military. The TSP offers several investment options to choose from, including target-date or "Lifecycle" funds based on your age. The U.S. government will match up to a 5% contribution of your basic pay to the TSP under the BRS. If you can, contribute even more. A good goal would be to target a total of 10% to 15% of your salary.

You don't need to be wealthy to be an investor, and getting started doesn't have to be difficult. As a new investor, it's important to understand these three general types of investments and how they can help you strike a balance between risk and reward.

- Cash investments offer lower returns, but they're smart for shorter-term goals, day-to-day expenses and emergency funds. They include checking and savings accounts, which are good for daily purchases and an emergency reserve; shorter-term certificates of deposit (CDs); and U.S. Treasury bills, which tend to pay slightly more interest but typically must be held for periods of three to 12 months. Money market funds, ultra-short bond funds and stable value funds are also options to consider.

- Bonds are investments that offer a predictable income stream. It's a loan you make to a government, municipality or corporation that in return promises to pay you a specified rate of interest and to repay the face value after a certain period of time, barring default. Bonds generally pay bondholders interest twice a year and are useful for preserving capital. As with any investment, bonds have risks but tend to be less volatile than stocks.

- Stocks are investments that represent ownership in a company. Stocks are relatively risky because the stock price may decrease, and there is no guarantee you'll be paid dividends. However, as a shareholder, you can achieve returns if the price of the stock increases and you sell at a profit, and if the company distributes some of its earnings to stockholders in the form of dividends.

You also can choose to mix and match different types of investments based on your risk tolerance, time horizon and personal preferences, and by using individual securities, fractional shares, mutual funds or exchange-traded funds (ETFs).

Stay Invested Throughout Your Military Career

If you've been investing for a while, you may be looking at nearer-term financial goals, like purchasing your first home or starting a family. However, a military career comes with unique challenges, such as moving every so often with PCS orders. Continuing to invest will help you reach your financial goals sooner despite the interruptions from the unique challenges you face in the military.

The best way to do this is by diversifying your investments so you're not putting all your eggs in one basket. For the uncertainty that comes with having a military career, diversification -- while not a guarantee against loss -- allows you to weather market ups and downs and stay in the fight. You can diversify your options to lower your risk by spreading your money across and within different asset classes, such as stocks, bonds and cash.

As your rank and pay increase, so should your savings. For those receiving bonuses for reenlisting or extending their service, investing is a great opportunity to put that money to work. One way to do this is by investing in your future retirement. While retirement may seem far away, the earlier you start, the more prepared you'll be.

Opening an Individual Retirement Account, either a Roth IRA or Traditional IRA, and contributing monthly is an additional cushion that can prepare you for retirement or extend your money while in retirement.

Keep Investing After Military Service

For those who are transitioning out of the military, keep in mind that, while your service is coming to an end, your investments shouldn't. Whether you're pursuing a new career path or starting retirement, investing can continue to help you reach your new goals.

Your investment strategy should be tailored to the life path you choose to take after leaving the military. Speaking with a financial adviser about your individual needs can help you determine your options to maximize your money in the next chapter of your life. New subscription financial planning services make accessing personalized investment management and financial advice more affordable and more accessible.

If you're starting a second career, you'll be introduced to different benefits and options, such as a 401(k) plan. If your company offers a 401(k) and employer match in investments, enrolling and setting up automatic deductions from your paychecks is an easy way to contribute to retirement. If you're able, consider contributing at least up to the employer's match in order to capture that benefit the company offers.

No matter what your next stage in life is, transitioning out of the military comes with new opportunities. Keep learning, and keep investing.

Jeff Hinrichs is a vice president and Financial Consultant with Charles Schwab, and a military reservist with more than 29 years of service.

Keep More of Your Money

Our Finance Newsletter can help. For the latest military news, financial tips and more, subscribe to Military.com and have the information you need delivered directly to your inbox.